by Chris Garlick | Mar 1, 2026 | Tax Law

Business Exit Planning Australia: Liquidity Isn’t the Finish Line For years, the sale of the business exists as an idea. It feels like a future event. A finish line. A day when everything will finally become lighter. Eventually, that day arrives. The documents are...

by Chris Garlick | Feb 22, 2026 | Tax Law

Business Exit Timing Australia: Why “Next Year” Is a Trap Markets change. Rules change. Bodies change. Almost every business owner says the same thing when selling becomes real: “Maybe next year.” At first glance, that sounds sensible. One more strong trading year....

by Chris Garlick | Feb 15, 2026 | Tax Law

Exit Tax Planning Australia: Why the Tax System Quietly Takes Your Side Why this moment is treated differently — and why timing is everything Most business owners assume one thing about selling: The Tax Office will take a large portion of the proceeds. That belief is...

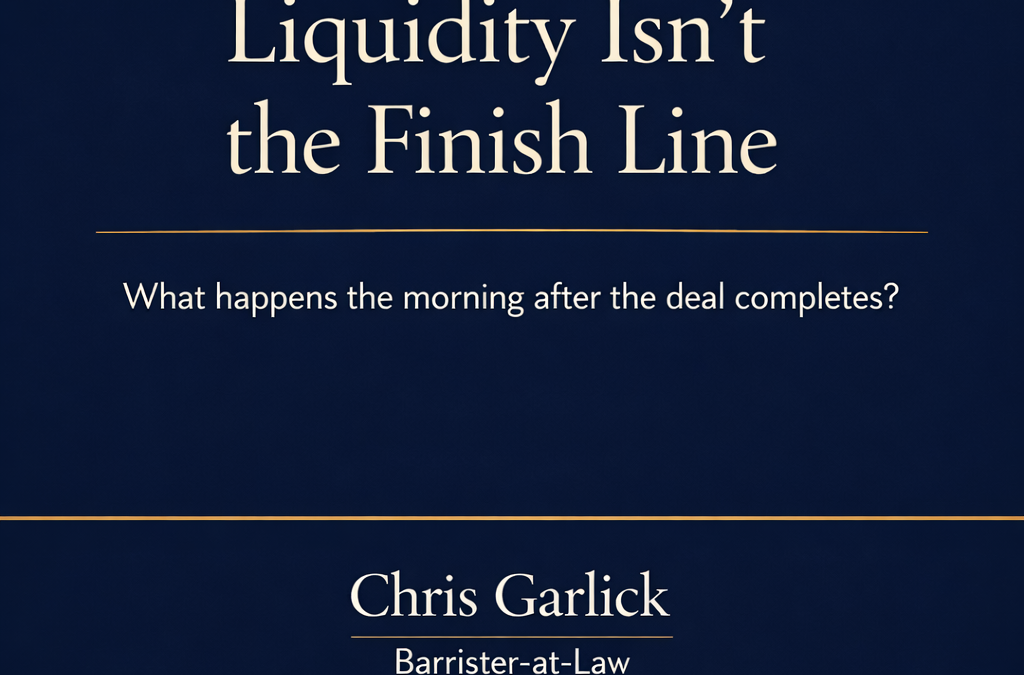

by Chris Garlick | Jan 22, 2026 | Tax Law

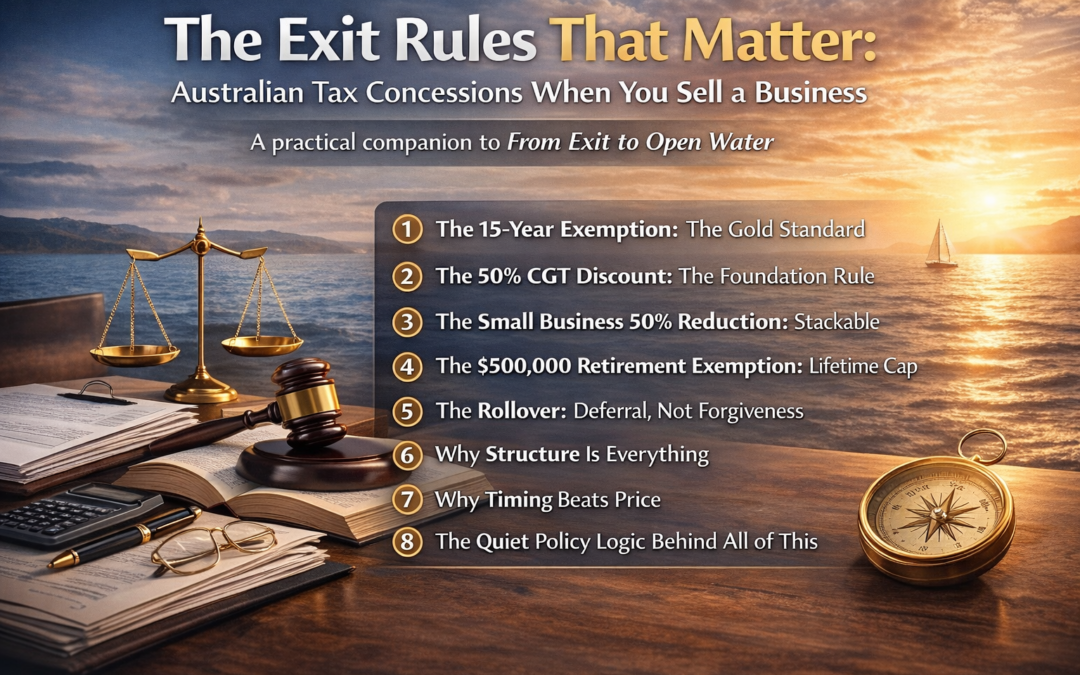

The Exit Rules That Matter: Australian Tax Concessions When You Sell a Business Australian tax concessions when you sell a business are often misunderstood, underestimated, or discovered far too late. When business owners hear “sell the business,” they instinctively...

by Chris Garlick | Jan 7, 2026 | Tax Law

Part I — The Moment the Question Appears “What if I didn’t do this forever?” It doesn’t arrive with drama. There’s no crisis. No boardroom blow-up. No collapse. In fact, the business is often doing just fine — sometimes better than ever. But one day, usually in a...

by Chris Garlick | Dec 25, 2025 | Tax Law

Christmas travel feels benign. Flights are booked, calendars clear, and the trip is mentally filed under family time. But in Australian tax residency disputes, Christmas travel is rarely treated as neutral. For the ATO, December and January movements often operate as...

by Chris Garlick | Dec 18, 2025 | Tax Law

Christmas Travel, Tax Residency & the ATO | Australian Residency Risks For most Australians, Christmas travel means family, rest, and a temporary escape from work. For the ATO, it can mean something very different. December and January travel is routinely examined...

by Chris Garlick | Dec 11, 2025 | Tax Law

Every week, I speak with Australians who haven’t lodged a tax return for five, ten, or even fifteen years. Some were living overseas. Others were bouncing in and out of Australia. A few were deep in cryptocurrency trading through companies or offshore platforms. Many...

by Chris Garlick | Dec 4, 2025 | Tax Law

Inheritance Tax in Australia – What Actually Gets Taxed When Someone Dies When people hear the phrase inheritance tax in Australia, many assume it doesn’t exist at all — and that an inheritance is simply “tax-free money.” That’s partly true, and partly very wrong....

by Chris Garlick | Nov 26, 2025 | Tax Law

Does the Prime Minister Get Special Tax Treatment in Australia? Every few weeks someone leans over a bar or a barbecue, lowers their voice and asks: “So… does the Prime Minister really pay tax like the rest of us?” It’s a fair question. The role comes with motorcades,...