by Chris Garlick | Oct 28, 2025 | Tax Law

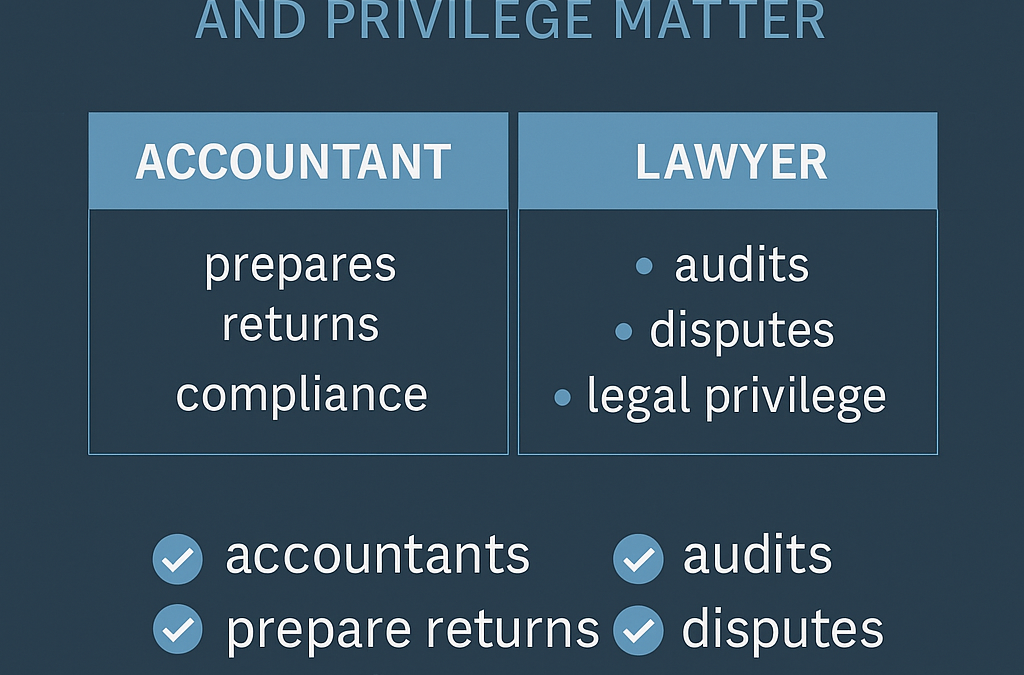

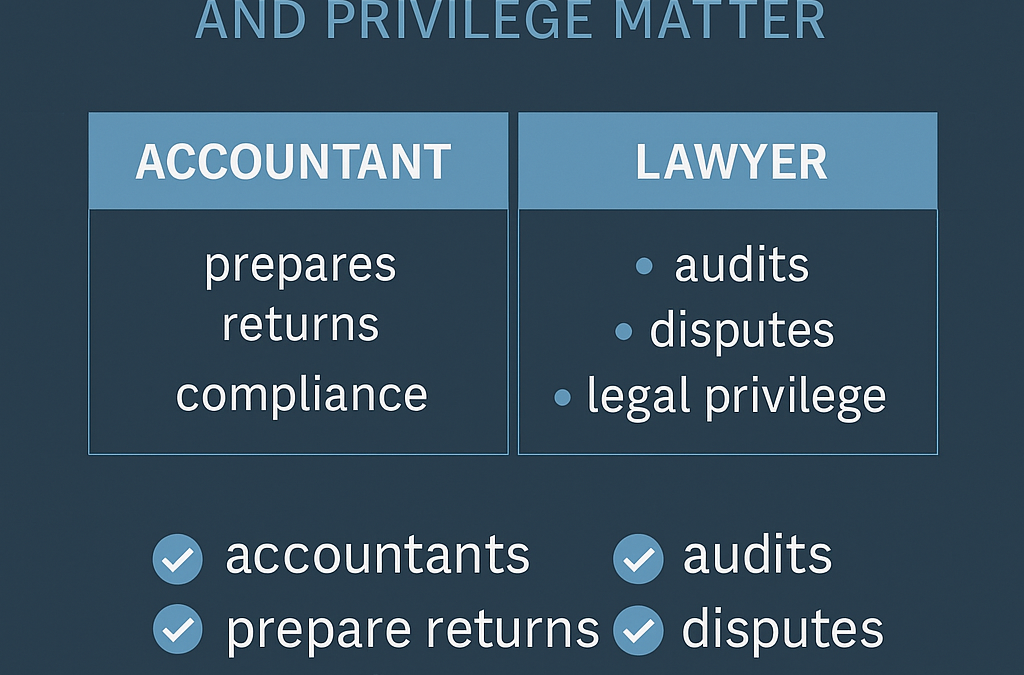

Why You Might Need a Tax Lawyer (Not Just an Accountant) Introduction When tax problems arise, many people think of calling their accountant first. But there are situations where an accountant isn’t enough — and only a tax lawyer has the expertise and legal...

by Chris Garlick | Oct 21, 2025 | Tax Law

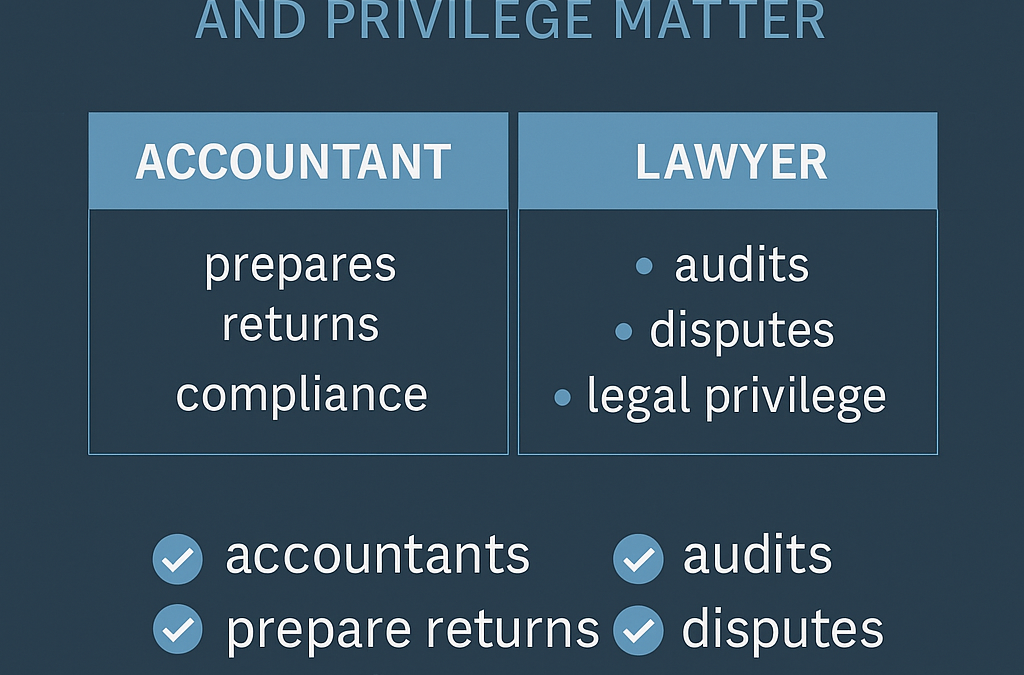

What is Bracket Creep—and Why the New Tax Cuts Might Not Feel Like Enough Introduction You may have heard of “bracket creep”, a silent income tax issue that often gets overlooked. Even with tax cuts on the way, inflation and wage growth can push you into higher tax...

by Chris Garlick | Oct 14, 2025 | Tax Law

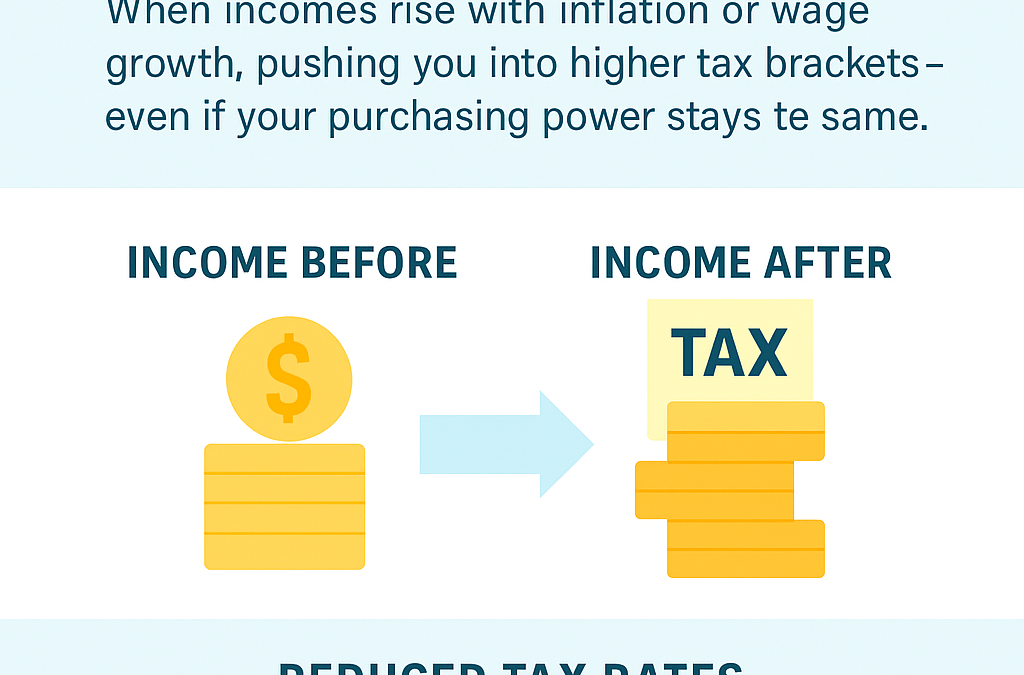

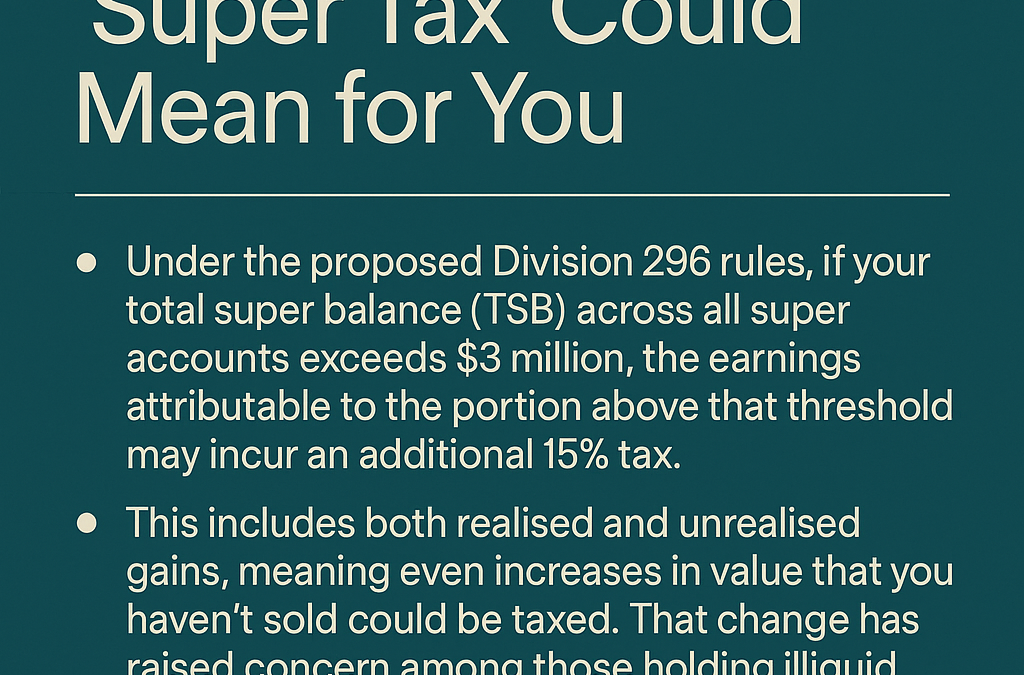

Is Your Super over $3 Million? What the Proposed ‘Super Tax’ Could Mean for You Introduction If your superannuation balance is above $3 million, you could soon face new tax rules. Division 296 is the proposed “super tax” targeting large super funds. From 1 July 2025,...

by Chris Garlick | Oct 7, 2025 | Tax Law

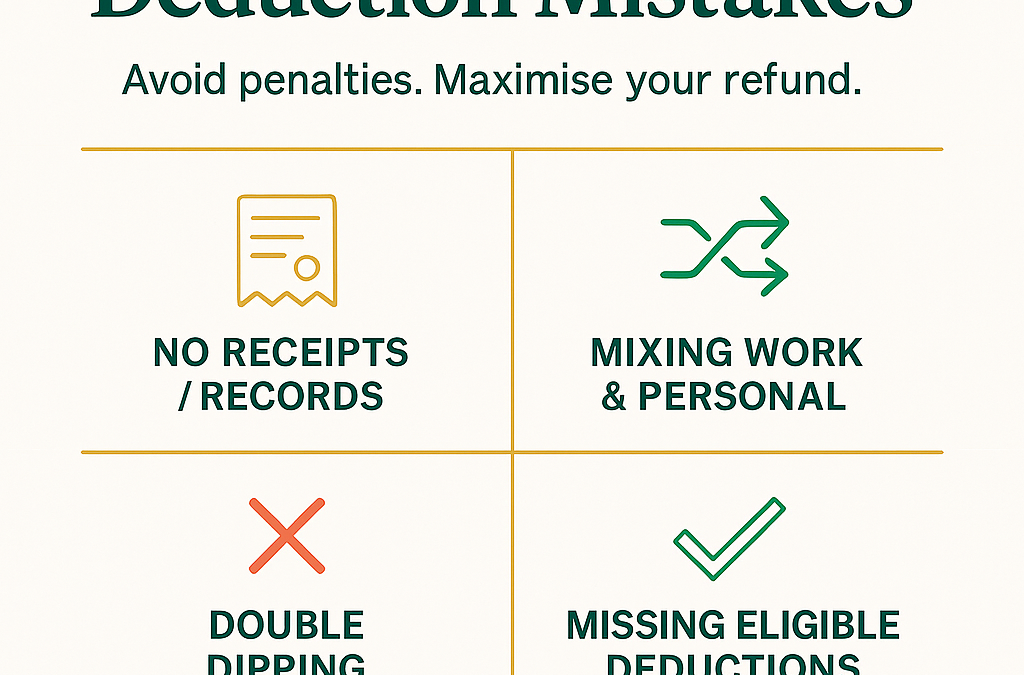

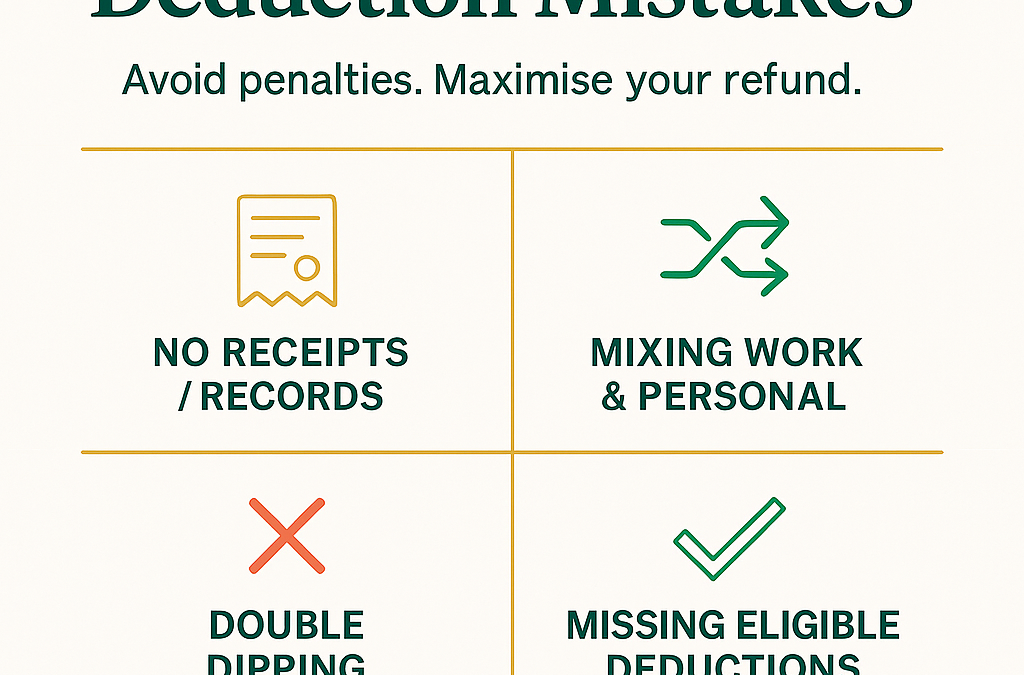

Avoid These Deduction Mistakes Before You Lodge Your Tax Return Claiming deductions is one of the easiest ways to reduce your tax bill, but mistakes are common — and some can carry penalties or delays. The ATO has been increasing scrutiny, so knowing what errors to...

by Chris Garlick | Sep 30, 2025 | Tax Law

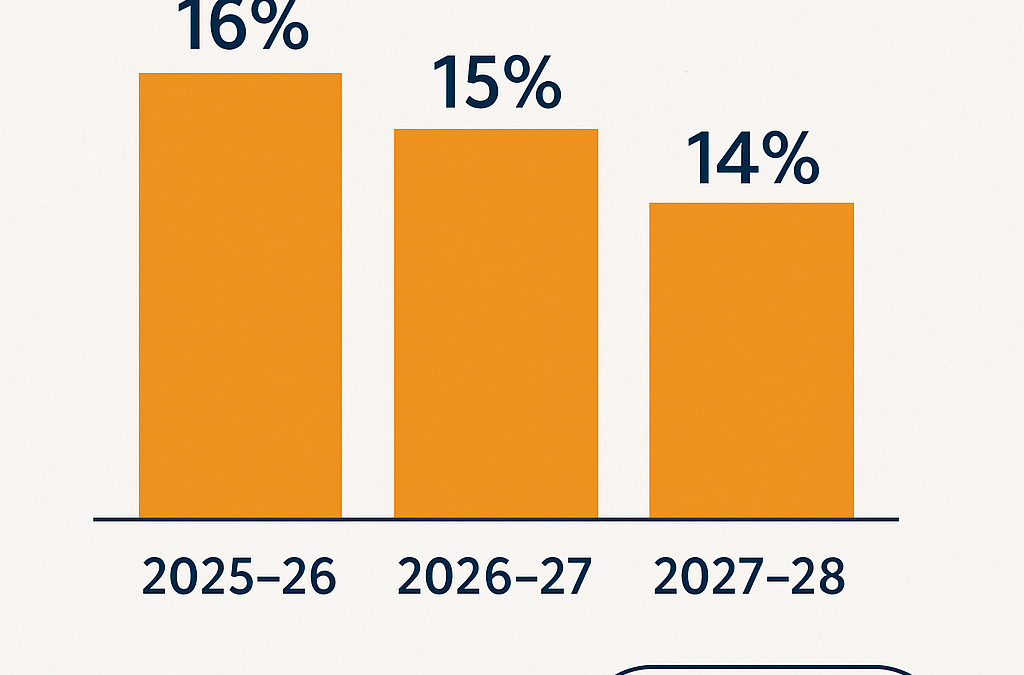

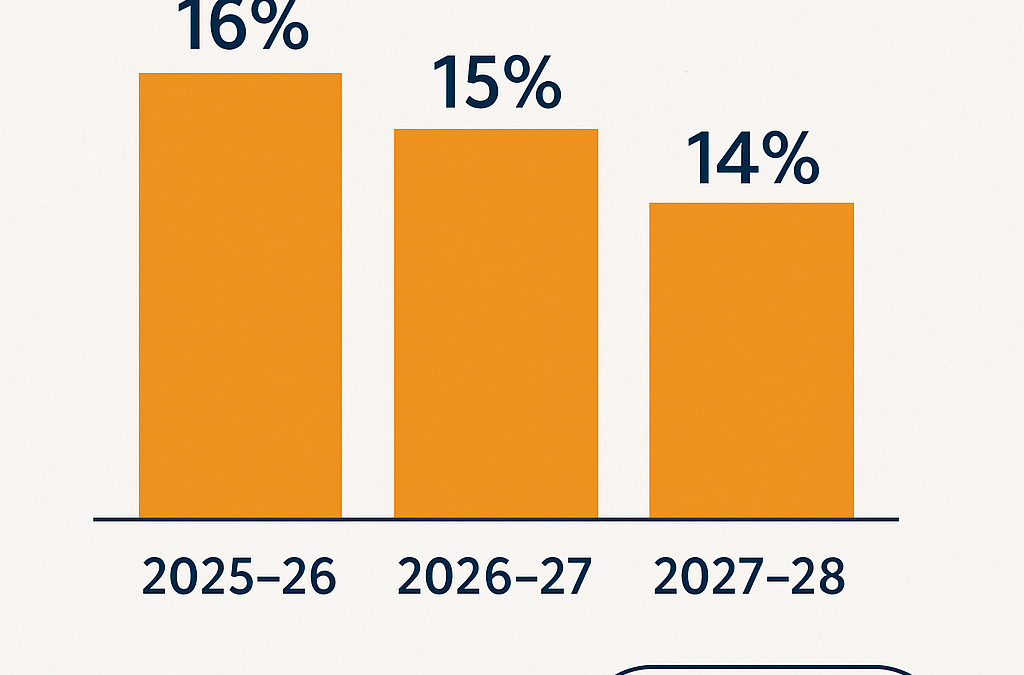

How the 2025–26 Income Tax Cuts Affect Your Take-Home Pay Tax time in 2025 brings meaningful changes to how Australians are taxed. The 2025–26 income tax cuts, part of the Stage 3 reforms, aim to ease inflation and rising cost-of-living pressures. But how much...

by Chris Garlick | Sep 23, 2025 | Tax Law

Tax Integrity and ATO Enforcement — Why You Need a Lawyer, Not Just an Accountant The Australian Taxation Office (ATO) has sharpened its focus on tax integrity and enforcement. With stronger data-matching, increased audits, and more resources for compliance,...