by Chris Garlick | Sep 16, 2025 | Tax Law

Entertainers and Australian Tax — Ricky Martin’s Tour Example When international superstars tour Australia, fans see sold-out arenas — but the Australian Taxation Office (ATO) also sees taxable income. This week we explore entertainers and tax, using Ricky Martin’s...

by Chris Garlick | Sep 3, 2025 | Tax Law

Inherited Property Exceeding 2 Hectares and Capital Gains Tax One of the most common questions in practice is what happens with inherited property exceeding 2 hectares — especially when the family inherits a small acreage rather than a standard suburban block. We’ve...

by Chris Garlick | Aug 27, 2025 | Tax Law

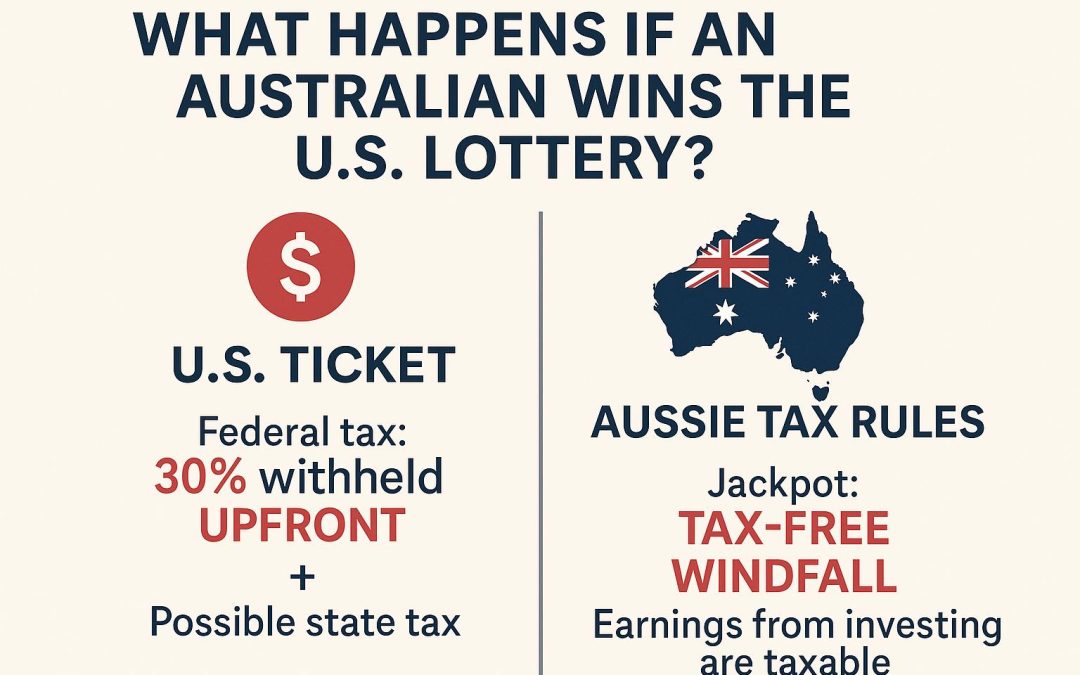

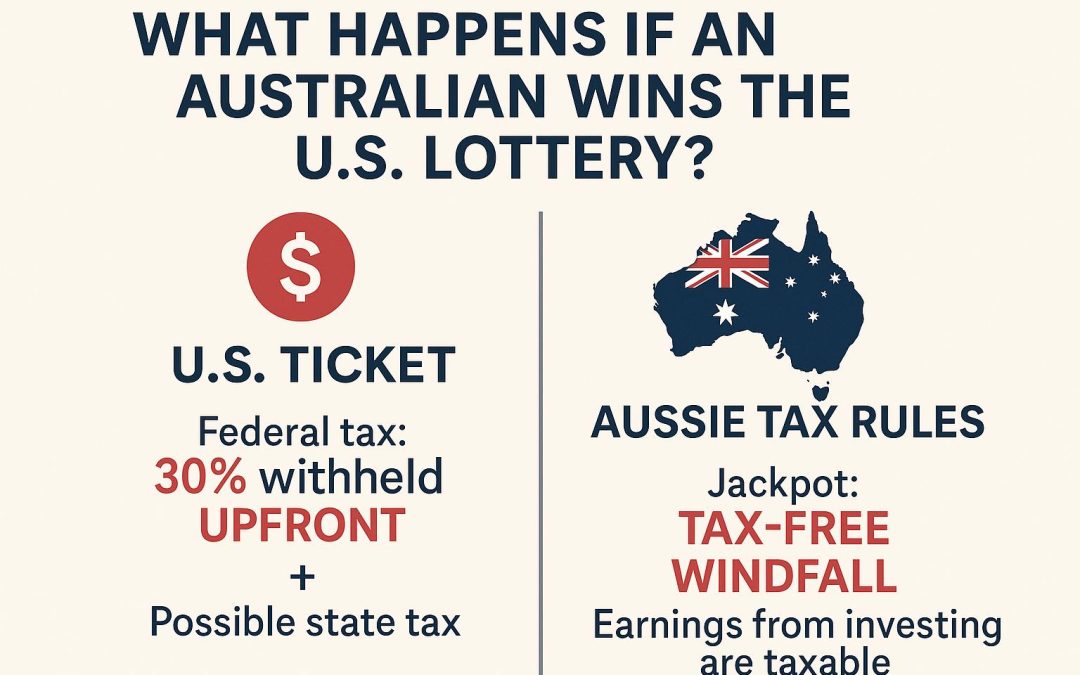

What happens if an Australian wins the U.S. lottery? It sounds like a dream — but the reality involves complex tax rules across two countries. Whether you bought a genuine U.S. lottery ticket or placed a bet through an Australian operator, the amount you actually take...

by Chris Garlick | Aug 20, 2025 | Tax Law

When life delivers more than one blow, the tax system doesn’t always feel like it’s on your side. But sometimes, it can be — if you know how to ask. A Story Too Many Australians Don’t Know – How ATO Hardship Provisions Work – “ATO hardship...

by Chris Garlick | Aug 13, 2025 | Tax Law

Frozen Funds in Drop Shipping Business – How Chris Can Help You Recover Running a global e-commerce store can be exciting – but frozen funds in drop shipping business can quickly stop your cash flow and cause major stress. Whether the freeze comes from a bank, payment...

by Chris Garlick | Aug 5, 2025 | Uncategorized

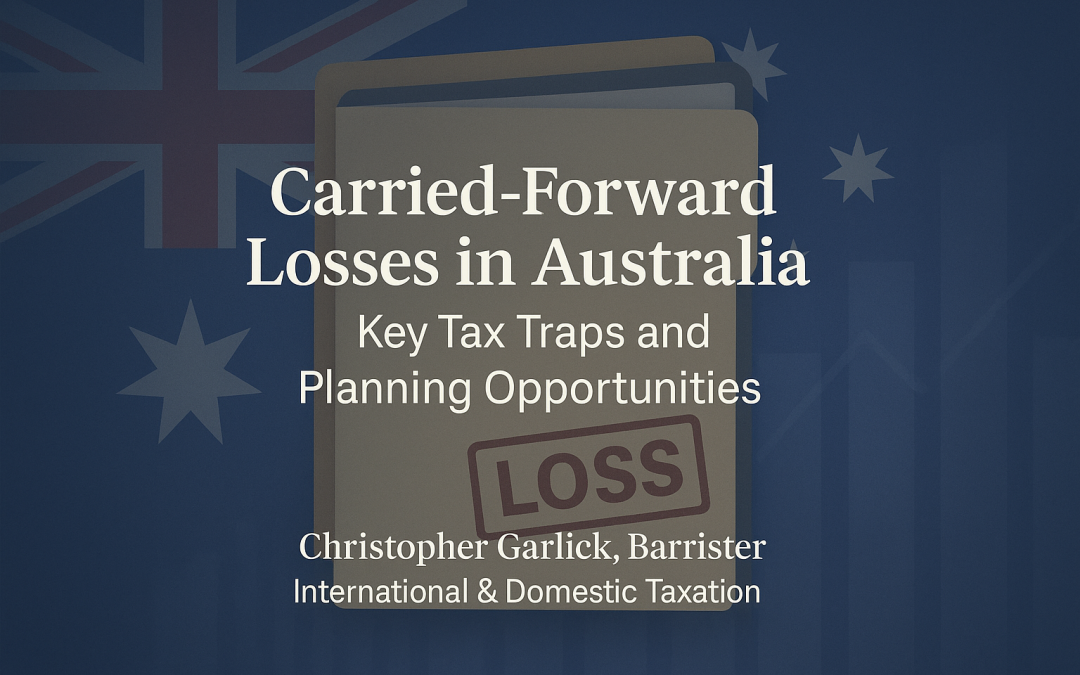

Carried-Forward Losses in Australia: Opportunities and Obstacles for Corporations By Christopher Garlick, Barrister-at-Law International and Domestic Taxation Law Introduction In today’s uncertain economic climate, many Australian corporations are holding substantial...