by Chris Garlick | Dec 18, 2025 | Tax Law

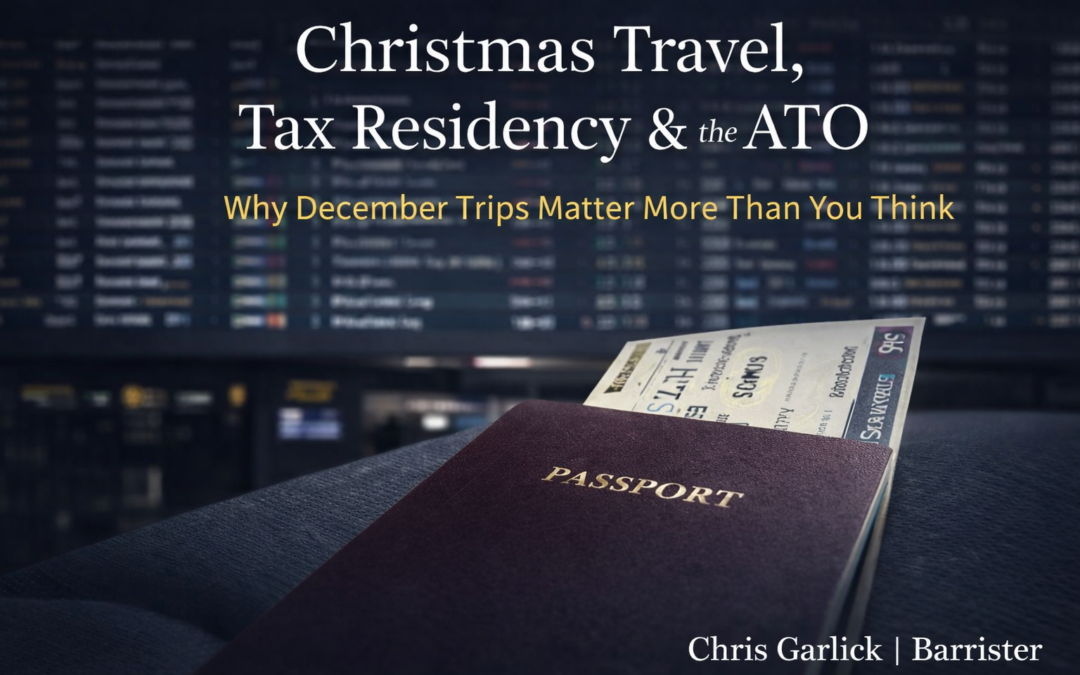

Christmas Travel, Tax Residency & the ATO | Australian Residency Risks For most Australians, Christmas travel means family, rest, and a temporary escape from work. For the ATO, it can mean something very different. December and January travel is routinely examined...

by Chris Garlick | Dec 11, 2025 | Tax Law

Every week, I speak with Australians who haven’t lodged a tax return for five, ten, or even fifteen years. Some were living overseas. Others were bouncing in and out of Australia. A few were deep in cryptocurrency trading through companies or offshore platforms. Many...

by Chris Garlick | Dec 4, 2025 | Tax Law

Inheritance Tax in Australia – What Actually Gets Taxed When Someone Dies When people hear the phrase inheritance tax in Australia, many assume it doesn’t exist at all — and that an inheritance is simply “tax-free money.” That’s partly true, and partly very wrong....

by Chris Garlick | Nov 26, 2025 | Tax Law

Does the Prime Minister Get Special Tax Treatment in Australia? Every few weeks someone leans over a bar or a barbecue, lowers their voice and asks: “So… does the Prime Minister really pay tax like the rest of us?” It’s a fair question. The role comes with motorcades,...

by Chris Garlick | Nov 19, 2025 | Tax Law

Introduction: The Strange Case of the Tax Resident of a Tree Australian taxation law has produced some unforgettable stories, but none stranger than the man who became a tax resident of a tree. It is a real example of how tax residency rules, the permanent place of...

by Chris Garlick | Nov 13, 2025 | Tax Law

Vanuatu Tax Residency: Why Australians May Still Be Taxable in Australia Vanuatu’s appeal is obvious: no personal income tax, no company tax, no capital gains tax, no wealth or inheritance tax. Apart from a 12.5% VAT on goods and services, the country promotes itself...